Homeownership Connection

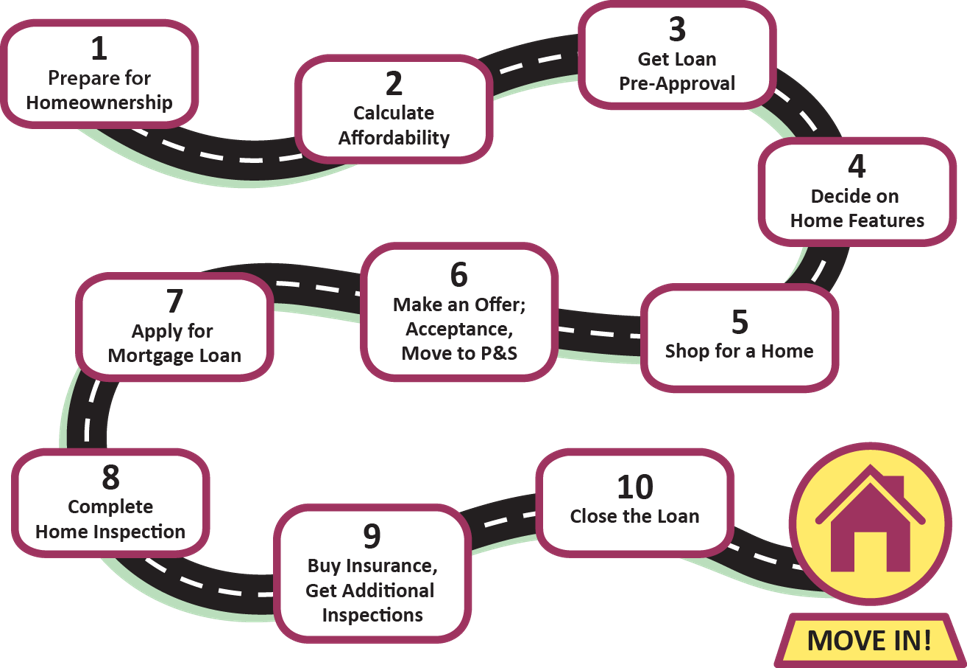

The pathway to owning a home just got a lot easier with a network of nationally certified homebuyer education classes and trainers. Let our experts lead you through the home buying process with educational tracks designed specifically for first time homebuyers and landlords.

There are a number of things you can do to help prepare yourself for purchasing a home, but the one thing that will make the biggest difference is educating yourself. The Housing Network and our HUD approved member organizations understand that high quality homebuyer education is the key to successful long-term homeownership.

“I’m really busy and don’t have time to take a class. Does it really matter?”

YES! National data proves that when homebuyers participate in high quality pre-purchase homebuyer education homebuyers have lower housing costs, improved credit scores and are less likely to experience foreclosure then homebuyers who did not participate in pre-purchase homebuyer education.

Our nationally certified homebuyer education program is the only HUD approved homebuyer education curriculum in Rhode Island and is designed to prepare individuals for successful homeownership. Not only will you have expert help to guide you through the homebuying process, but should you ever need guidance down the road, you’ll have access to a HUD Certified Housing Counselor who can answer your questions.

Basic Homebuyer Education

Cost: $99 per household (up to 2 co-borrowers)

What you’ll learn about:

- Credit and budgeting

- How much you can afford

- Understanding fees and costs

- Purchase process

- Choosing a lender and mortgage product

- Down Payment Assistance Programs

Classes are available:

- In English and Spanish

- Daytime, evening and Saturday classes

- 2 hour and 4 hour increments, single day

- In person, virtual “in –person” and self-directed online

- Convenient locations in Providence, Pawtucket, Newport and Woonsocket

What you’ll receive:

- 8 hours of HUD approved Homebuyer Education (group setting)

- 1:1 session with a HUD certified housing counselor

- Individualized Action Plan to help get you on track and achieve success

- Your Credit Report

- Certificate of Completion (valid for 2 years)

- Access to a HUD certified housing counselor during and post-closing

Check out our Calendar Page for upcoming classes and registration information.

Are you interested in owning a multi-family? Do you want a better understanding of what it takes to be a good landlord? This 3-hour class is designed to cover the basics on your rights and responsibilities as a landlord under Rhode Island law and provides you with the tools you need to successfully rent your unit.

Landlord Education

Cost: $79 per household (up to 2 co-borrowers)

What you’ll learn about:

- Understanding the cost of owning a multi-family home

- Fair housing law

- Accepting rental vouchers

- Elements of a lease

- Selecting the right tenant

- Dealing with rent delinquency

- Eviction

Classes are available:

- In English and Spanish

- Daytime, evening and Saturday classes

- Convenient locations in Providence, Pawtucket, and Woonsocket

What you’ll receive:

- 3 hours of group education by a HUD certified housing counselor

- Copy of the Rhode Island Landlord Tenant Handbook

- Certificate of Completion (valid for 2 years)

- Access to a HUD certified housing counselor during and post-closing

Check out our Calendar Page for upcoming classes and registration information.

Questions? Contact Niva Barros.

401-721-5680 x 101 or nbarros@housingnetworkri.org

Classes delivered in partnership with:

Frequently asked questions

Have more questions you want to get answered about the homebuying process?

Check out our Calendar Page for upcoming classes and registration information.